Do I need a customs broker to import goods…

… into Canada?

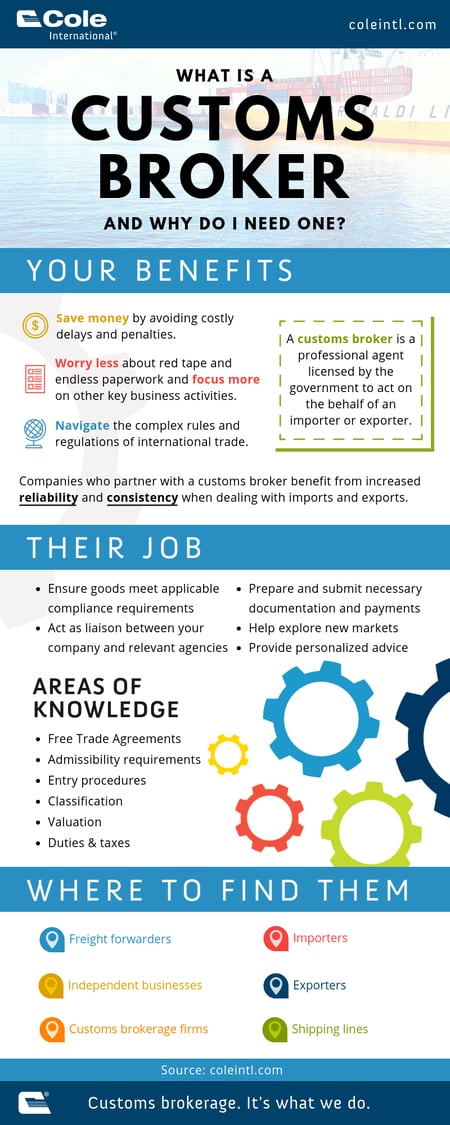

No business or individual is compelled to enlist a customs broker to help clear goods through Customs. Individuals may represent themselves or, with Power of Attorney, an employee can complete a declaration to CBSA on his or her company’s behalf. (Note, though, that only a licensed customs broker can represent companies other than their own.) READ: The Value of a Great Customs Broker.

Licensed by CBSA, customs brokers act as agents for commercial businesses importing products into Canada. They apply their knowledge of trade requirements and regulations to secure the release of product shipments by Canada Customs and such government agencies as Agriculture Canada, Health Canada and the Ministry of Transportation (among others). They can also assist in determining, for each product, the most suitable HS tariff code. As the regulations governing the increasingly complex world of cross-border trade are constantly changing, partnering with a qualified customs brokerage makes good business sense.

… into the United States?

You can import up to $2,500 worth of goods without a customs broker’s assistance; however, whether CBP officers accept your declaration or request that you obtain the services of a broker is at their discretion.

What paperwork is required?

When importing into Canada

Importers typically use either a Commercial Invoice or a Canada Customs Invoice (CI1) that specifies the product details, total value of goods, country of origin, shipper and consignee, and other information. To take advantage of preferential duty rates, free trade certificates (when applicable), specialized document or authorizations may be required. Requirements and benefits relating to preferential treatment should be discussed with your customs broker.

To account for commercial imports into Canada, importers must usually complete the Canada Customs Coding Form (B3). CBSA often audits B3 entries and issues AMPS penalties for non-compliant information.

All the forms required for shipping and importing good are available on our website under Tools & Resources > Forms.

For most commercial shipments entering Canada, CBSA requires either a commercial invoice containing all the information outlined in Memorandum D1-4-1 or a fully completed Form CI1, which identifies the buyer and seller of the goods, price paid or payable, product details (including quantity, characteristics, packaging, weight and so on), and much more.

This 51-field CBSA form calls for such information as tariff treatment or trade agreement, country of origin, tariff classification, value for duty and the appropriate duty and tax rates. If you choose to import goods on your own, bear in mind that submitting the B3 constitutes your declaration that the information is 100% correct.

To deter non-compliance and help level the playing field for all Canadian businesses, CBSA uses AMPS to penalize commercial clients for violating trade and border legislation.

When importing into the United States

For imports into the U.S., you can use a Commercial Invoice. The detailed information you must provide includes the consignee’s Federal ID. To take advantage of preferential duty rates, free trade certificates (when applicable) are also required.

All the forms required for shipping and importing good are available on our website under Tools & Resources > Forms.

A document provided by the person or corporation exporting an item across international borders. It must include a few specific pieces of information such as the parties involved in the shipping transaction, the goods being transported, the country of manufacture, and the Harmonized System codes for those goods.

Is there any benefit to using different customs brokers depending on the mode of transportation or the port of entry?

To the contrary, there are far more benefits to using a single customs broker willing and able to look at the big picture of your business and develop an intimate understanding of the products you ship and the ways you ship them. Over the long term, you’ll reap far more value from a broker who understands all of your company’s “moving parts” and has the know-how and experience to deliver integrated, cost-efficient solutions.

Using the services of more than one broker to manage your “account” can expose your company to potential errors or inconsistencies and increase the likelihood of an audit. If this does happen, you’ll want a broker with a dedicated Audit Response Unit ready to assist.

A place where people and goods may lawfully enter a country – typically an airport, a sea port or a border crossing. In Canada alone, Cole International has 39 branches offering customs brokerage and freight forwarding services – a breadth of locations and services few brokers can match. We have branch offices in all major Canadian cities and at strategic locations along the border and throughout the United States, including locations that operate 24/7/365. We offer nationwide services with remote filing capabilities at all Canadian and US border crossings, airports, rail stations and ocean ports where physical offices are not located.

Customs agencies vies each importing business as a single “account.” Regardless of the port of entry, mode of transportation or carrier, all duties and taxes owing to Customs are applied to the single account associated with your company.

How do I pay duties and taxes?

Many customs brokers will facilitate the payment of their customers’ duties and taxes owing before CBSA or CBP’s deadlines, reducing hassles and headaches while enhancing the importer’s ability to manage cash flow and payables.

For example, once credit has been established, a broker can pay CBSA for any monies owing for each shipment processed and then issue your company an invoice covering all applicable duties, taxes and fees to be paid in full within 21 days.

Direct payment to CBSA: For all import duties and taxes payable, CBSA issues a statement of account on the 24th of each month for each importer and must receive payment in full by the first business day of the same month. For details, see the CBSA website.

Direct payment to CBP: For all import duties and taxes payable, CBP must receive payment in full within 10 business days of clearance. CBP’s Automated Clearinghouse (ACH) is an electronic payment option that allows participants to pay customs fees, duties and taxes electronically. For details, see the CBP website.

Are there restrictions on what can be imported into Canada or the U.S.?

Yes. CBSA enforces importation regulations on behalf of nearly 60 other Canadian government agencies, which prohibit many different items from entering Canada if they do not meet certain criteria. Similarly, in the United States, CBP and Homeland Security enforce regulations on behalf of all government agencies, which prohibit many different items from entering the United Stated if they do not meet specific criteria.

A customs broker can provide the advice and information required to determine if your products can be allowed into the country and whether permits or additional documents are needed.

What if my current customs broker classifies my goods incorrectly?

With Canadian Customs, applying the wrong HS tariff code to your goods can have serious consequences including a full Customs audit, additional duties, interest and/or significant penalties under AMPS. CBSA can also suspend your import privileges.

In the U.S., harmonized tariff classification is the ultimate responsibility of the Importer of Record. Potential consequences in reporting the incorrect tariff information to Customs include potential penalties and interest charges, further scrutiny and delays of your shipments, and the possibility of full Customs audits.

Senior Trade consultants can assist you in the proper classification and reporting of your goods. They can also assist in correcting previous mistakes and filing Prior Disclosures, which can protect the importer from penalties.

To determine the applicable rate of import duty and taxes, CBSA uses the World Customs Organization’s (WCO) Harmonized Commodity Description and Coding System (HS). Accuracy in assigning HS tariff codes is crucial, as incorrect tariff information can result in overpayments or underpayments of duty, potential penalties and interest charges, further scrutiny and delays at the border, and the possibility of Customs audits.

Why use a freight forwarder instead of booking directly with a carrier?

Freight forwarders are non-asset-based service providers that receive client requests and customized services to satisfy the client. A freight forwarder organizes shipments for individuals or corporations to get goods from the manufacturer or producer to a market, customer or final point of distribution. Most freight forwarders contract with multiple carriers.

The freight forwarder will assist with the origin point loading and transport, destination on-forwarding insurance requirements and load consolidations – complete door-to-door solutions.

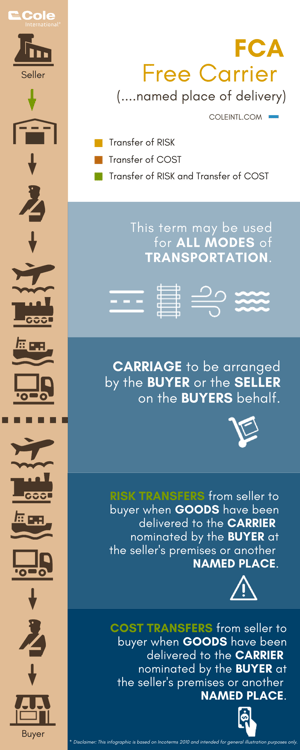

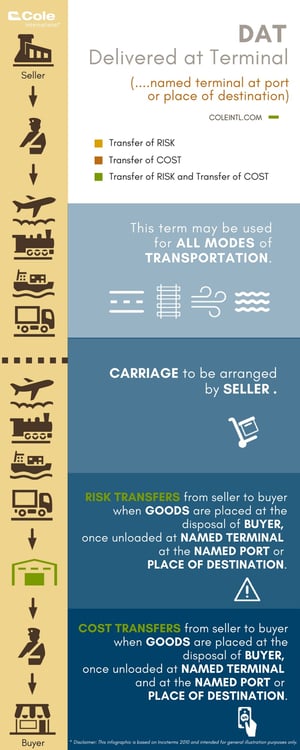

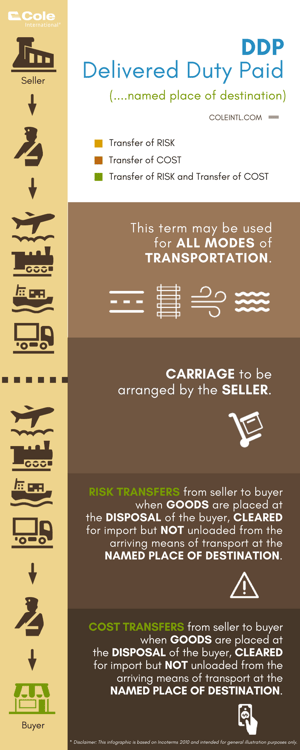

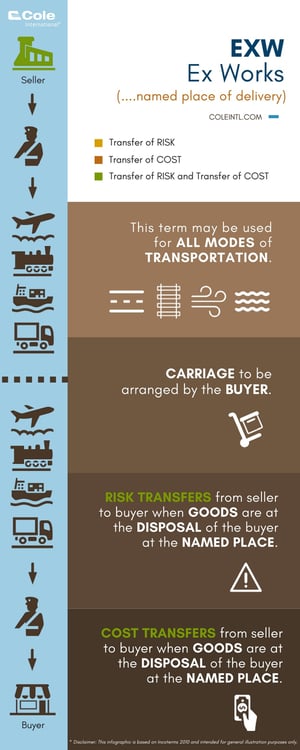

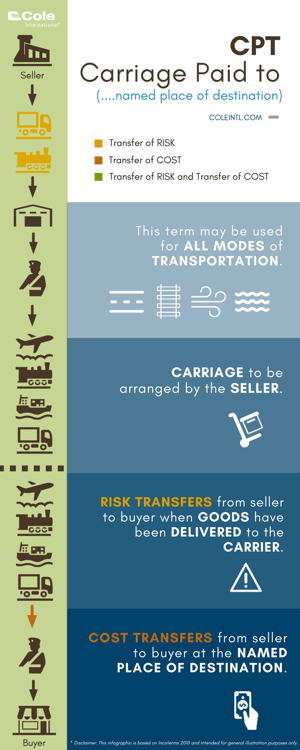

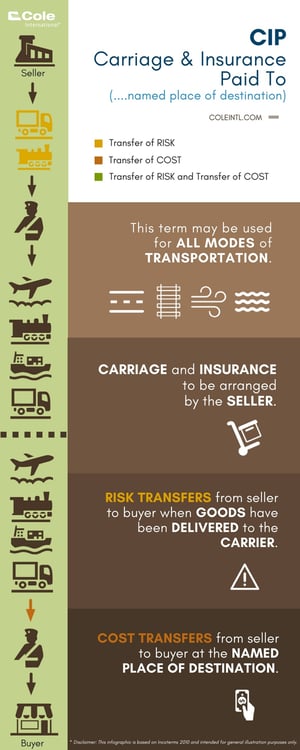

What are Incoterms?

Incoterms, or international commercial terms, are standard sets of terms and conditions designed to assist traders when goods are sold and transported. Published by the International Chamber of Commerce, they are intended to clearly communicate the costs and risks associated with the transportation and delivery of goods. The Incoterms rules are used by buyers and sellers worldwide for the interpretation of the most commonly used terms in international trade.

You’ll find the full listing of current Incoterms here.